The value you bring to any project as a designer or user experience professional isn’t only your ability to execute a series of tasks. Good clients will recognize and appreciate the guidance, recommendations and opinions that come with your experience. It’s up to you to be forthcoming and to position yourself as a valuable thinker from the start.

It’s also up to you to base your recommendations on more than subjective opinion. This is especially true in the rapidly evolving world of mobile, where clients typically require as much education as they do execution.

Further Reading on SmashingMag:

- Facing Your Fears: Approaching People For Research

- A Closer Look At Personas

- The Rainbow Spreadsheet: A Collaborative Lean UX Research Tool

- How Copywriting Can Benefit From User Research

Project-specific research provides the dual benefit of enhancing your general knowledge while improving your ability to make (and sell) decisions as the project progresses. In my experience, gaining that critical buy-in is much easier when recommendations are based on research conducted for the project.

In this post, I’ll refer to specific mobile research projects I’ve conducted and build a case for audience surveys, participatory discovery sessions and review of analytics data.

Practicality Vs. Personality

A paper from Carleton University (PDF) suggests that consumers simply have jobs to do and seek to employ the best product or service to do it. Applying this thinking to how users interact with mobile websites places more importance on “What do I need to find/do” than on anything related to their demographic. Mobile Web users have jobs to do that aren’t driven by age, gender, education, income, etc. This “practicality” is key to how I approach research.

“The jobs that customers are trying to get done cannot be deciphered from purchased databases, but rather from watching, participating, writing and thinking.” (Source of quote and image: Finding the Right Job For Your Product)

Fitting Research And Analysis Into Your Process

Mobile research is a considerable value-add that should be baked into your services to the client from the start. It enables you to make better decisions and to inform your client of what their audience expects from a mobile experience.

I recently finished guiding Loyalist College through a research phase that included a mobile component. The project is currently in production and is slated to launch early this year.

In this case, I faced unique challenges when selling the value of the proposed research to my client. Loyalist had already conducted research, but the research was more focused on uncovering general best practices and on clarifying the psychographics and demographics of its customers.

I suggested adding a more practical, goal-oriented research component (which was ultimately accepted) as a way to help us build a better product. Most of your clients probably understand well who their customers are but lack a solid grasp of what those customers want from a mobile experience.

Audience Research

The best way to determine what users expect to find and do in the mobile channel is to ask.

There are a few ways to approach this.

Participatory Discovery Sessions

The Loyalist College project included two sessions in which members of the target audience were asked, quite simply, what they expected to find and do, and how these tasks might best be performed on a mobile device. I also asked how many of the participants use a smartphone as their primary computing device. The data collection method in a session like this is as follows:

- Ask participants to contribute approximately 10 things they expect to find and/or do when using their mobile device in the context of the products or services provided by your client. Each item should be written on a sticky note.

- Collect the sticky notes and arrange them visibly, like on a wall or table.

- Ask participants to review all suggestions and place a star or mark on the three responses that they think are most important.

- Discuss the starred responses with the group to seek additional information.

Surveys

I’m working with 3M Canada on a consumer-facing mobile project that consists of multiple phases of research. In partnership with a research firm, we’re using surveys to learn more about how a very specific, targeted set of customers use their smartphones and what the probability is that they’d be interested in using the application we intend to build. We’ll use the results of this survey to define the features that will ultimately make it easier for users to do their job.

Building and distributing surveys are easy using a tool such as Fluid Surveys or Survey Monkey. If the budget is available, my advice is to seek the assistance of a research firm that can help you accurately craft the survey and find the most relevant set of participants. For a project with a tighter budget, you could certainly create, distribute and analyze a survey using a tool such as Fluid Surveys or Survey Monkey.

In my experience, once you’ve defined the purpose of the research initiative, the following are important to consider:

- Keep the questions focused and simple.. Every question should tie back to the goal of the research and be focused on the expectations and habits of mobile users as they relate to the project. Keeping the questions simple lowers or eliminates any barriers to respond.

- Avoid open-ended questions.. Whenever possible, pose questions that require respondents to answer yes or no, via multiple choice, or by rating on a scale. Data of this nature is much easier to analyze and allows you to build recommendations based on objective responses, rather than have to attempt to further interpret subjective feedback.

- Use incentives.. A survey that I deployed for a project for the Golf Association of Ontario received over 5,000 responses. Our client was kind enough to offer an incentive of entering participants into a draw.

- Define your audience well.. Soliciting responses from a general audience can be difficult, and the results are not always accurate. My suggestion is to work with your client to identify an audience (staff, customers, etc.) and to send the survey directly via an email list or other targeted communication channel.

Analytics Review

Slicing and reviewing analytics data from an existing Web presence can be an effective way to determine what mobile users are doing with the content and features available. For the Loyalist College project, I was interested in a simple report of the most popular content accessed from mobile devices.

Keep in mind, especially when using Google Analytics, that mobile phones and tablets are lumped together in the default “Mobile” group. Because mobile and tablet use cases are typically very different, I like to segment phones explicitly as part of the analysis. Here’s how:

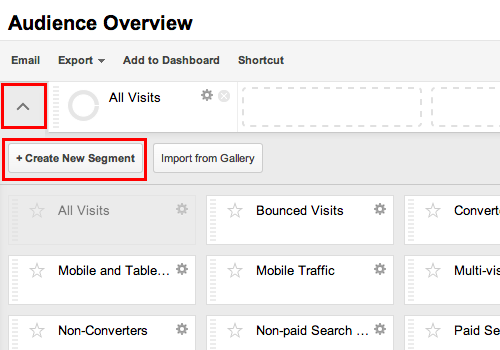

- Create a new custom advanced segment by selecting the arrow on the “Audience Overview” landing page.

- Name the new segment (something like “Phones”).

- In the “Technology” section, choose to include mobile traffic and exclude tablet traffic.

You can now analyze the data and create reports for phones only.

I recently used this approach in a large project for the Middlesex-London Health Unit. Part of our plan was to consider mobile as the cornerstone of a large Web redesign project and to treat the mobile experience as a priority from the start, rather than an afterthought. With access to the client’s analytics account, I was able to slice the data and reveal the following:

- On average, the website received 250 mobile visits per day.

- The most popular content for mobile users was a health-related game, information on immunization clinics and career opportunities.

Armed with information such as this, I was in a much better position not only to recommend how the content should be prioritized for mobile users but also to demonstrate the general importance of including mobile as a foundational element of the website redesign project.

I took a similar approach with the Loyalist project. In addition to identifying the number of mobile visitors and the content priorities of those users, I was able to communicate to my client that visits from mobile devices had doubled from 2012 to 2013.

Identifying Themes

Researching the expectations of mobile users has little value until the research is put to use. I like to include a step between research and execution in which I summarize the findings via a series of “themes.” Themes are a familiar concept that simplify the process of grouping findings together, while encompassing a number of tactics to be implemented in the project.

The research that I conducted for the Loyalist project revealed the importance of a centralized events calendar, especially on mobile. Using this data, I created a theme called “Events Matter” and outlined the results of the research and what the new mobile experience would do to capitalize on this theme. It’s important to be specific here and let your client know exactly what you think should be done to capitalize on the results of the research.

The themes can be used to create planning materials, like a creative brief, flowcharts or a scope of work document. Recently, I’ve found myself forgoing these components in favor of building visual concepts directly from the themes and spending more time in rapid iteration, as opposed to drawn-out planning.

Closing Thoughts

Mobile is causing the way we interact with the Web to change at an unforgiving pace, a shift that requires guidance from well-informed professionals like you. Your responsibility is not only to produce great work but to educate and guide your clients through something that most of them can’t keep up with.

Selling research as part of your process will be more effective if you can show clients specific examples of how you’ve used research in the past. My advice is to bake research into your next project as a value-add for the client. You can keep it simple by taking the following steps:

- Conduct an analytics review, and use the data to support at least one key decision in the project.

- Create a brief survey, and ask the client to provide access to it from their existing website. Again, use the results of the survey to support one key decision.

Continually build your research practice from project to project by going deeper with your analytics reviews, adding more survey questions, integrating discovery sessions and building complete themes that guide the project in a meaningful way.

Research is a fantastic, accessible way to increase your perceived value while helping to shape the future of the Web and ensuring that the software and websites we build keep pace with users’ ever-advancing expectations. Businesses value proof and, in my experience, appreciate a conversation that starts with explaining a body of proof before presenting a set of specific recommendations.

(al, ea, il)

(al, ea, il)